Card payments are increasing all over the world because they provide several advantages. On the other hand, businesses should make sure that they protect the data of customers safely to avoid fraudulent activities. It is necessary to prevent the card details from hackers and data breaches when people buy a product online or offline. The card issuing companies focus more on implementing the best practices when it comes to data security. Tokenization processing is one among them which gives ways to make payments safely that will help avoid threats from cyberattacks.

What is tokenization?

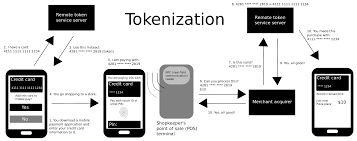

Tokenization is a technique meant for replacing sensitive information with tokens. They use a string of random numbers which represent a cardholder’s details during the payment process that will help a lot to ensure more protection from potential threats. It also passes through a payment gateway to avoid the exposure of credit card information. Another thing is that it provides ways to remove sensitive data from a system that will help to prevent identity thefts and other problems to a large extent.

What are the benefits of payment tokenization?

- Reduces risks from unethical practices

Criminals often follow unethical practices to steal the details of cardholders. As a result, it will lead to a loss of money that will affect the credibility of card issuing companies. Apart from that, businesses may face a lot of problems that will impact their growth in the markets. Therefore, it becomes necessary to minimize data breaches with the latest approaches for ensuring peace of mind. Tokenization is an effective strategy that allows a business to prevent negative financial impacts.

- Builds trust with customers

Safety is the major concern of most customers when they make card payments. Since card fraudulent activities are growing day by day, businesses are in a position to earn their trust and credibility. With tokenization, it is possible to build trust with customers that will help grow sales in the markets. Another thing is that it paves ways to streamline cash flow in a business to generate high revenues.

- Reduces red tape for a business

Businesses that accept debit card and credit card payments should make sure that they are compliant with PCI DSS to ensure high protection. Tokenization gives ways to maintain compliance with industry regulations that will help reduce red tape for a business. Leading payment companies let a business focus more on its growth by offering the best payment processing solutions. Red tape for a business can impact a business in various ways and tokenization provides solutions for this problem significantly.

- Drives payment innovations

Nowadays, customers use wallets and mobile apps for making a card payment. Hence, a business should ensure that they make the payments easier and safer. Tokenization allows mobile phone users to process card transactions without any hassles. It offers an additional layer of security for them with the most advanced technologies. Besides that, it improves user experience in card payments to lower unwanted problems. Customers can also prevent their cards from hackers and others with tokenization that will help reduce potential risks.