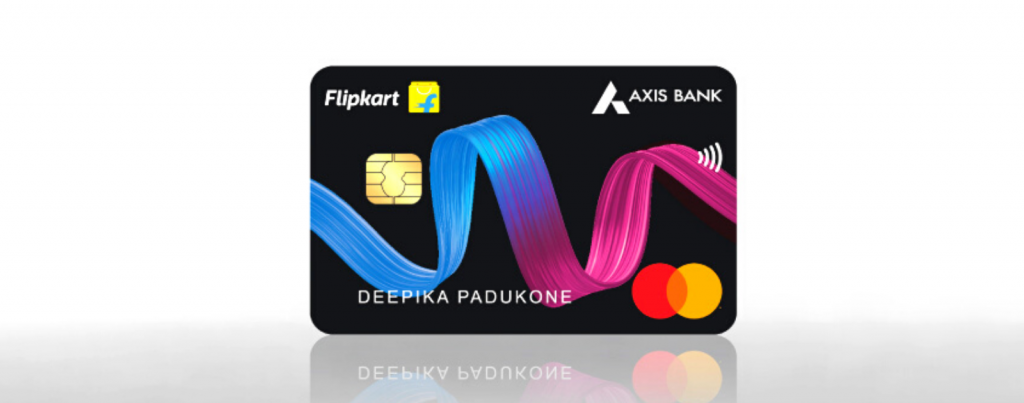

Axis Bank and Flipkart have joined forces to create the Axis Bank Flipkart credit card. Customers will generally receive advantages while purchasing online on other platforms such as Tata Sky, PVR, Myntra, and so on, but if they purchase on Flipkart and pay with the Flipkart Axis bank card, they will receive attractive promotions and rewards.

The Flipkart Axis Bank Credit Card is an entry-level card that requires a minimum income of Rs. 15,000 for salaried individuals and Rs. 30,000 for self-employed individuals. The age range is from 18 to 70 years old.

Eligibility & Document Requirements

Axis Bank provides a variety of credit cards to suit its clients’ aspirations and desires. Axis bank offers a variety of ways to be eligible for a Flipkart To be eligible for an Axis bank credit card, an individual must meet the bank’s credit card eligibility requirements, which include:

- The add-on cardholder must be at least 15 years old.

- A Flipkart Axis Bank Credit Card is only available to Indian citizens and non-residents.

- The primary cardholder’s minimum and maximum ages are set at 18 and 70 years old, respectively.

- A salaried or self-employed candidate must earn a minimum of Rs. 15,000 and Rs. 30,000, respectively, to be considered.

Required Documents for a Flipkart Axis Bank Credit Card

- Passport-size photograph

- Income Proof (Form 16/IT return/payslip)

- Address Proof (Passport/Ration Card/ Utility Bills)

- Identity Proof (Passport/PAN/Aadhaar card/Driver’s licence)

The Flipkart Axis Bank Credit Card allows you to enter a world where you may earn cashback on every transaction. There’s no limit to how much you may earn with this card because it offers accelerated cashback in all of your favourite categories, including travel, retail, entertainment, and lifestyle.

Welcome/activation benefit:

- If you make your first purchase within 30 days, you will receive a Rs. 500 welcome voucher.

- You will receive a 5% cashback for purchases made on the Flipkart and Myntra platforms.

- Spending on approved retailers earns you 4% cashback (Uber, Swiggy, PVR, Curefit, Tata Sky, Cleartrip, Tata 1MG).

- All other retailers earn you 1.5 percent cashback.

- 4 gratis visits to a domestic lounge (one per calendar quarter).

- Waiver of 1% of monthly fuel costs up to Rs. 500.

Cashback: The flat cashback rate on Flipkart is quite generous as compared to other cards in the market.

- Cashback of 5% is available on Flipkart, Myntra, and 2GUD

- Get a cashback of 4% on all your preferred merchants.

- All other categories earn 1.5% cash back.

Aside from the cashback and co-branded introductory perks, the Flipkart Axis Bank Credit Card also offers the following features:

- Every year, you are entitled to four complimentary domestic lounge visits.

- For transactions between Rs. 400 and Rs. 4,000, there is a 1% fuel cost waiver (maximum waiver of Rs. 500 in a month).

- Up to a 20% discount is available at 4,000+ partner restaurants.

Fees & Charges:

The Flipkart Axis Bank Credit Card comes with a substantial welcome bonus of Rs. 1,600. In comparison to the Rs. 500 membership cost, this represents a significant return on investment for the user.

Axis Bank maintains the right to set the Axis Bank Flipkart credit card limit at its discretion. The bank officials decide on the credit limit approval during the review and verification of the Flipkart Axis bank credit card application. The credit card limit is influenced by a number of criteria, including Credit score, income, existing debt, and so on.

Credit Card Reward Points:

The Flipkart Axis Bank credit card reward points system enhances the cardholders’ experience even better. On every transaction, consumers receive credit card reward points, which may be redeemed at any time by the client.

The biggest perks of the Flipkart credit card are geared towards Flipkart and its partner retailers because it is a co-branded card. One of the greatest cashback credit cards in India is the Flipkart Axis Bank Credit Card. Users can earn up to 5% cashback on purchases made on Flipkart, Myntra, and other partner websites, as well as a flat 1.5 percent cashback on all other purchases.

Read Also: What is a Slice Credit Card?